Disapply pre-emption rights. If a company wants to allot new shares without first offering them to the existing shareholders, it will usually need to authorise the directors to disapply these pre-emption rights. Our model sets out a sample form of resolution. Allotting shares. Companies have a responsibility to signal an intention to seek a non-pre-emptive issue at the earliest opportunity and to establish a dialogue with the company’s shareholders. They should keep shareholders informed of issues related to an application to disapply their pre-emption rights.

- Disapply Pre-emption Rights

- Resolution Disapply Pre-emption Rights

- Disapplication Of Pre-emptive Rights

- Pre Emption House Naperville

Disapplication of pre-emption rights. Once a request to disapply pre-emption rights has been approved, shareholders expect companies to discharge and account for this authority appropriately. It is recommended that the subsequent annual report should include relevant information such as the actual level of discount achieved, the amount. Pre-emption rights provide existing shareholders (members) of a company first refusal on the issue, transfer, or transmission of shares in that company. Rights of pre-emption are deemed necessary to protect members against involuntary dilution of their existing shareholdings, i.e. A reduction in the percentage of their current stake in the company. Shareholders can of course choose to disapply the pre-emption rights should they wish. On an agreed sale of shares it is sensible for a shareholder to confirm in writing that they waive their pre emption rights. This protects both the outgoing shareholder and the new shareholder in the future should the existing shareholder wish to bring a.

Pre-emption is the name given to a right of first refusal in favour of existing shareholders for the allotment of new shares in a company. We consider the role of the Pre-Emption Group in relation to recommended practice by listed companies.

A pre-emption right is an anti-dilution mechanism that allows shareholders to preserve their percentage shareholding in a company provided they have sufficient funds available to exercise their rights.

Statutory pre-emption rights on the allotment and issue of ordinary shares or the rights to subscribe for or to convert securities into ordinary shares are imposed under the Companies Act 2006. In the context of a private company, contractual pre-emption rights are also commonly found in the company's articles of association, shareholders' agreement or a trust deed.

Pre-emption rights can be valuable to shareholders, but the Act does allow the directors of a company to disapply or modify the operation of statutory pre-emption rights in certain circumstances.

The role of the Pre-Emption Group

The Pre-Emption Group initially published its pre-emption guidelines in 1987 in relation to considerations to be taken into account when assessing a company's case for disapplying pre-emption rights in the UK equity capital markets.

The Group aims to provide clarity on the circumstances in which flexibility might be appropriate and the factors to be taken into account when shareholders are considering the case for disapplying pre-emption rights or making use of an agreed authority for a non-pre-emptive share issue.

Its most recent Statement of Principles applies to both UK and non-UK incorporated companies whose shares are admitted to the premium segment of the Official List of the UK Listing Authority.

Companies whose shares are admitted to the standard segment of the Official List, to trading on AIM, or to the High Growth Segment of the London Stock Exchange's Main Market are encouraged to adopt the Statement.

It's not a set of rules but intended to provide a basis for discussion of the business case between companies and their investors. The Statement is updated periodically, most recently in March 2015.

Some of the key elements of the 2015 Statement of Principles are:

- clarification that it applies to all issues of equity securities undertaken to raise cash for the issuer or its subsidiaries - irrespective of the legal form of the transaction, including for example 'cashbox' transactions

- flexibility to undertake non-pre-emptive issuance of equity securities in connection with acquisitions and specified capital investments, consistent with existing market practice

- greater transparency on the discount at which equity securities are issued non-pre-emptively.

Recent updates

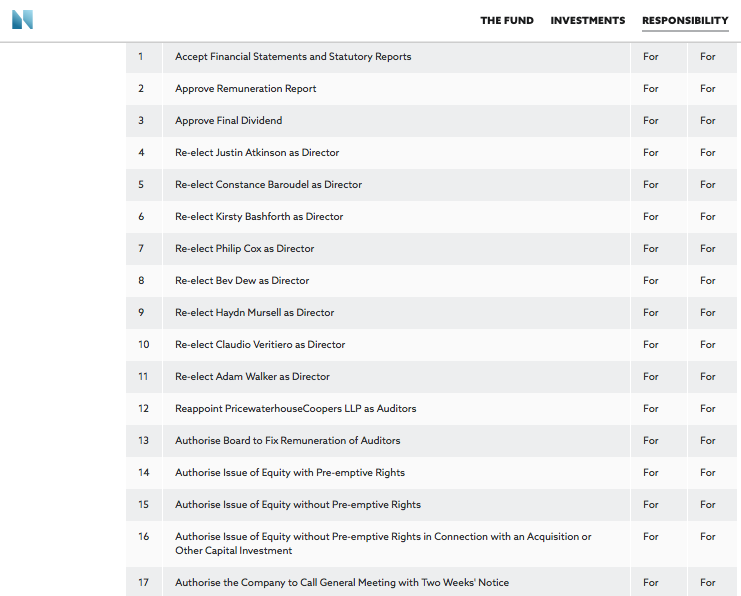

In May 2016 the Pre-Emption Group published a template resolution outlining good practice in requests for disapplication. This template provides for companies to propose separate resolutions to authorise a company to disapply pre-emption rights:

- on up to 5% of its issued share capital; and

- for an additional 5% for transactions which the board determines to be an acquisition or other capital investment as defined by the Statement.

If you are a shareholder of a company and would like to understand your pre-emption rights and/or the protections you have against further shares being issued, then please do not hesitate to contact the author to discuss your pre-emption rights.

What Are Preemptive Rights?

Preemptive rights are a contractual clause giving a shareholder the right to buy additional shares in any future issue of the company's common stock before the shares are available to the general public. Shareholders who have such a clause are generally early investors or majority owners who want to maintain the size of their stake in the company when and if additional shares are offered.

A preemptive right is sometimes called an 'anti-dilution provision.' It gives the investor the option of maintaining a certain percentage of ownership of the company as it grows.

Key Takeaways

- A preemptive right allows an early investor to maintain voting clout in a company even if new shares are issued.

- The right can also protect the early investor from a loss if the new shares are priced lower than the initial shares.

- Preemptive rights are routinely offered only to early investors and majority shareholders, not to all shareholders.

In addition, the preemptive right may protect the investor from a loss if the new round of common stock is issued at a lower price than the preferred stock owned by the investor. In this case, the owner of preferred stock has the right to convert the shares to a larger number of common shares, offsetting the loss in share value.

Understanding the Preemptive Right

The preemptive right clause is commonly used as an incentive to early investors in return for the risk taken in financing a new venture.

This right is not routinely granted to all shareholders. Several states grant preemptive rights as a matter of law but even these laws give the company the ability to negate that right in its articles of incorporation.

A preemptive right is essentially a right of first refusal. The shareholder may exercise the option to buy additional shares but is under no obligation to do so.

Preemptive Right

Preemptive rights protect a shareholder from losing voting power as more shares are issued and the company's ownership becomes diluted.

Since the shareholder is getting an insider's price for shares in the new issue, there also can be a strong profit incentive.

At the very least, there is the option of converting preferred stock to more shares if the new issue is priced lower.

Disapply Pre-emption Rights

The Benefit to Companies

It is less expensive for a company to sell shares to current shareholders in a new offering than to sell shares to the general public, as the company would not need to pay for investment banking services.

These savings would lower the company's cost of equity, and hence its cost of capital, increasing the firm's value.

Resolution Disapply Pre-emption Rights

Preemptive rights also are an incentive for companies to perform well so they can issue a new round of stock at a higher valuation when necessary.

The preemptive right offers the shareholder an option but not an obligation to buy additional shares of stock.

Example of Preemptive Rights

Disapplication Of Pre-emptive Rights

Let's assume that a company's initial public offering (IPO) consists of 100 shares and an individual purchases 10 of the shares. That's a 10% equity interest in the company.

Down the road, the company makes a secondary offering of 500 additional shares. The shareholder who holds a preemptive right must be given the opportunity to purchase as many as 50 shares, or 10%, of the new offering. The investor can exercise that right and maintain a 10% equity interest in the company.

Pre Emption House Naperville

If the investor decides not to exercise the preemptive right, the company will sell the shares to other parties and the early shareholder's ownership percentage in the business will decline.